What Is a Rent Roll? [Ultimate Guide for Property Owners]

Fact-checked

Fact-checked

Last Updated: March 16, 2022

If you’re a property manager, you know how important it is to keep track of rent payments. But what if you need to track payments from tenants spread out across multiple properties? This is where a rent roll comes in handy. And just what is a rent roll? This article addresses everything you need to know about a rent roll—how to use it, who benefits from it—and provides an example of how it all works.

What Is a Rent Roll?

The rent roll definition includes essential documents that list all the rental units an investor owns, along with lease details. They’re designed for each rental real estate asset type to help property owners and managers understand their properties’ income streams and manage their finances more efficiently.

The information listed on a rent roll includes whether a particular rental unit is occupied or not, along with details on who occupies it—consisting of a tenant’s name, contact information, payment history, the amount of deposit being held, and the current lease expiration date.

How Does a Rent Roll Work?

Rent rolls work by breaking down the cost of rent per apartment unit. But they also give the total rent amount for the entire rental property portfolio, known as master rent rolls. Landlords fill out a rent roll template as part of a record-keeping process of their rental properties. The template is designed to collect rent data from each tenant’s lease agreement and organize it into one, easy-to-read document.

Landlords must update rent rolls as soon as there are changes to have an accurate document on the current state of their properties’ tenant base and income at all times.

Even though the template format can vary—depending on the type of the rental property—all rent roll forms contain the following information.

-

Tenant Name

This includes the current tenant’s name, who occupies the rental property. The tenant name is left vacant if the premises are unoccupied when rent rolls are produced.

-

Unit Number

This is the number of the rental unit that a tenant occupies.

-

Unit Size

The rent of a tenant’s apartment is calculated by the apartment’s square feet.

-

Net Rentable Square Footage Percent

The rent roll meaning is also based on the tenant’s unit size in a percentage of the total square footage occupied by the tenant. For example, if a tenant lives in a 1,000 sq. ft. apartment and the building is 10,000 sq. ft., the tenant occupies 10% of the net rentable square footage.

-

Rental Rate

This is the amount of rent the tenant pays. There are typically two rental rate columns in a rent roll: one shows the property value per sq. ft. annually, and the other shows the total gross rent amount per month.

-

Annual Rent

This field of the rent roll contains the value of the total annual rent for the premises, calculated by multiplying the monthly rent by 12.

-

Lease Start and End Date

A rent roll must contain the date when the lease begins and when the lease expires.

-

Lease Term

The lease term—for both the lessee and lessor—establishes when the lease begins and ends. There are typically three lease term types: fixed, periodic, and indefinite.

-

Security Deposit

Most rent rolls contain a security deposit section, which states the amount of security deposit held for the tenant.

As a landlord, it’s crucial to know how to create a rent roll since the information it contains provides you with an accurate insight into the current state of your rental units. It will also help you make better decisions regarding the income potential of your rental property.

| DID YOU KNOW? Rent rolls can be created for any real estate that produces income, including single-family houses, multifamily buildings, commercial properties (shopping centers, office buildings), and land that’s been leased for agricultural use. |

How to Use a Rent Roll

What does a rent roll look like, and how do you use one? A rent roll can be used by sellers and buyers, property managers, landlords, and real estate investors. Even though many real estate practitioners focus on balance sheets and profit and loss statements, properties’ rent rolls can provide a significant amount of information on a single page.

The following list includes the most common ways rent rolls are used.

Tenant Turnovers

You can use rent rolls to get a big picture of how many property vacancies you’ve had over a certain period. You can see the tenant turnover rate over a year, two years, or more.

If you discover that your property has a history of high tenant turnover and vacancy rate, you should find out what’s causing the problem. By performing a rent roll analysis, you can see if the landlord has chosen a good service for tenant screening, if there’s maintenance trouble or a more complicated problem, such as a weak market for that property type or issues in the neighborhood.

Rent Growth

Keeping track of rent increases on properties can be challenging for landlords. They compare same-month reports, year after year, to see if their rental revenue has increased and by how much. With rent rolls, you can compare that amount to the average growth rate for other rental units in the area to see how your property is performing.

You can also use this rent roll example to compare your unit to other rental units’ market prices. But remember, when you raise the rent of a unit that’s turned over, you increase the rent for other long-term residents, as well.

On-Time Payments

Analyzing the data that shows whether your tenants are paying their rent on time helps determine the respective tenant’s character and how responsible they are. Knowing if your tenant makes on-time payments will also help you decide whether to renew their lease.

If the rent roll analysis shows that your tenant is not consistently paying their rent, you might want to consider marketing the house for lease if the demand for that kind of rental property is high.

Eviction Count

Another way rent rolls prove to be helpful is when inspecting the eviction count. If you notice that a property replaces a tenant every year or even more often, it’s a good idea to note how often a tenant has been evicted.

If the rent roll template confirms that the tenant was evicted, you can ask if they had left voluntarily or had been taken to court and about the cost of repairs and legal fees before the property could be rented again.

Late Fee Income

Many landlords consider late fee income as an additional source of revenue. If a tenant is late on their rent and has to pay a late fee, the effective rate would be higher than the monthly rate they were supposed to pay in the first place, which means that the landlord would get a few extra bucks.

But if you consider buying a property whose rent roll forms show that the existing tenant always pays late, beware. If they decide to leave, you’ll end up paying more money on legal and repair fees.

| DID YOU KNOW? Landlords believe that charging a late fee is one of the best ways to encourage tenants to be consistent in making on-time payments. How much rent you’d charge depends on your local and state laws, and, typically, a late fee is 5% of the rent or less. |

Key Takeaways

| The rent roll definition includes essential documents that list all the rental units a landlord owns, along with the leases’ details. |

| This document contains information about the tenant, payment history, security deposit, and length of residency, as well as the lease’s duration. |

| Rent rolls can be generated for any real estate that produces income. |

| Rent rolls provide information about tenant turnover, rent growth, eviction count, payment frequency, and late fee income. |

Who Benefits From a Rent Roll?

So what is the benefit of a rent roll report? There’s not just one benefit; landlords are not the only ones that find this report helpful. The following list includes several others who deem this report crucial when understanding rental properties and their income streams.

What Does a Rent Roll Look Like for Property Managers and Landlords?

Landlords and property managers can significantly benefit from rent rolls to improve their rental property management. The following are some examples that show the importance of rent rolls.

- Landlords and property managers can use them to identify tenants falling behind on rent payments.

- Landlords can review leases and identify which ones are soon expiring to know when to send a lease renewal letter.

- Rent rolls for a landlord provide necessary information about their property and a tenant.

- Rent rolls help landlords with a market analysis of current market rental fees.

Rent Rolls for Mortgage Brokers and Lenders

Banks, mortgage brokers, and lenders are experts in utilizing rent rolls by:

- Evaluating the risk of making a loan, opening a home equity line of credit (HELOC), or conducting a cash-out refinance

- Determining how profitable property is and predicting potential income generation of a rental property

- Showing a history of high tenant turnover rate to help with the decision to loan money for future investments.

Rent Roll Meaning for Real Estate Investors

- Real estate investors significantly benefit from rent rolls, as they give them all the information needed to verify their rental property income, determine its potential, and anticipate issues with cash flow.

- Investors also use rent rolls to compare them to the income line on their profit and loss (P&L) statement to understand if the gross income is accurately reflected. After conducting a comparative market analysis (CMA), the rent roll shows if the tenant is paying fair market rent.

Rent Roll Definition to Buyers and Sellers

Note the following most common ways buyers and sellers use a rent-roll.

- Buyers use rent rolls to understand cash flows and determine if a property would be a good investment.

- Sellers use them to monitor property performance.

- If the rent roll shows that a tenant’s lease is up for renewal, a seller who continuously extends the lease might be able to sell the unit at a higher price since it comes with a responsible tenant.

| DID YOU KNOW? Rent rolls provide many benefits for landlords, property managers, lenders, and buyers. They are also effortless to monitor. Knowing how to create a rent roll eases the process of calculating fees, monitoring lease terms, checking for due rent, and much more. |

Rent Roll Example

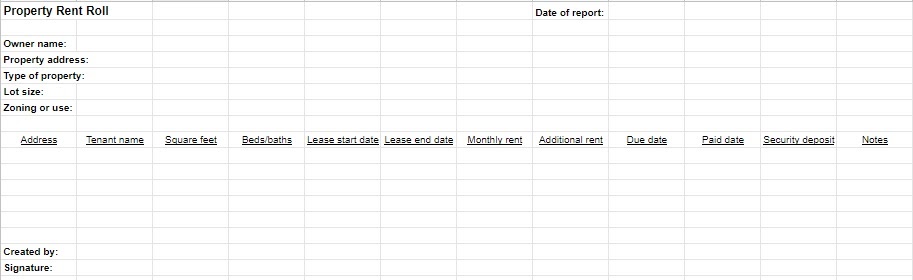

Rent rolls are easy to create. Any rental property owner can generate one using spreadsheet software like Microsoft Excel, Google Sheets, or OpenOffice Calc. Note the example below of how they should look.

This basic rent roll example demonstrates how it tracks information about each tenant. You can see how much rental income you received last month or which tenant is late with payments by filling in the fields. You can also generate reports based on this data to understand your business better. Having this information at your fingertips tremendously helps with decisions about your business and its future.

Conclusion

What is a rent roll? A rent roll is an essential document for landlords, property managers, lenders, and buyers. It provides information about rents that are due or late, fees, and lease terms and gives a picture of the property’s gross rental income. With a rent roll, you can make better financial and management decisions regarding your rental properties.

![How to Find Someone’s Tinder Profile? [2024 Expert Guide]](https://review42.com/wp-content/uploads/2023/06/Finding-Someone-on-Tinder.jpg)