Form 1099 Instructions [Simple-To-Follow Guide for 2024]

Fact-checked

Fact-checked

Last Updated: February 13, 2024

There are many terms associated with filing taxes. If you’re self-employed, a freelancer, or a small business owner hiring people on a contractual basis, you should have at least heard of the 1099 form. Curious about how to complete one? In this article, we will discuss form 1099 instructions in detail, including what the form is, how to fill it out, and the penalties if you miss submitting it to the IRS.

What Is a Form 1099?

A 1099 form is submitted to the IRS to report additional income apart from your regular salary. This includes capital gains, as well as income from dividends, banks, or any freelance work. Small business owners who hire freelancers or independent contractors also submit this form.

It is important that a taxpayer reports all of their income to calculate the right amount of tax. Not reporting the income is tax fraud and you can be charged with severe penalties if you fail to report accurately.

Types of 1099 Forms

In order to understand the 1099 form meaning, you should be aware that there are over 20 varieties of a 1099 form. Below we’ve listed out some of the other most common ones.

1099-NEC

NEC stands for non-employee compensation. This form is used by companies and business owners who have paid non-employees $600 or more during the year for their services. Payments can be made to an individual, estate, corporation, or partnership. Examples include fees paid to attorneys like lawyers, accountants, or non-employee salespeople.

1099-MISC

1099-MISCstands for miscellaneous income, or miscellaneous information. Per the IRS, you should file this form if you’ve made any of the following payments:

- $10 in royalties or broker payments in lieu of dividends or tax-exempt interest, or

- At least $600 in rent, medical payments, prices, and bonuses, or payments to an attorney. This is very similar to the IRS 1099-NEC.

1099-INT

This form is issued to report interest income. It is issued by payers of the interest income to receivers of income or the investors. Interest payers like banks, brokerage firms, and mutual funds must file this form if they’ve paid $10 or more in interest.

1099-DIV

If you’ve started to understand the pattern of abbreviations, you might have guessed that this form is used to report income from dividends. You will receive this form if dividends you own have been paid over the financial year.

1099-G

Tax form 1099 also includes a 1099-G form that reports unemployment compensation or state tax refunds you received during the financial year. If you’ve received any payment from the government, you may need to include this information on your income tax returns.

1099-R

This form focuses on income through pensions, retirement plans, or other passive income. Any individual who receives more than $10 through annuities, profit-sharing plans, or insurance contracts needs to fill out this form.

1099-B

This form is sent by brokers to record people’s gains or losses in the share market during the year. Tax is calculated based on the gross profit, that is, gains minus the losses.

1099-S

This part of the 1099 tax form and is used to report income from any real-estate transactions and certain royalties. It includes the sale or purchase of any property, property improvements, and services of any future ownership interest.

Who Should File a Form 1099-NEC?

Any business that makes a payment of $600 or more during a financial year to non-employees fills out this form. It is filled by payers and is used to calculate the actual taxable income.

How to Fill Out a Form 1099-NEC

We know that taxes are pretty complicated, so here is a step-by-step guide to help you fill out this form:

1. Collect the Required Information and Documentation for Each Independent Contractor

The first step is collecting all the necessary information and documentation for each independent contractor. This includes

-The total amount you paid them during the tax year

-Their legal name

-Their address

-Their taxpayer identification number (TIN). This is likely their social security number (SSN) unless they are a non-resident

-Their W-9 form

-The physical 1099 NEC form

2. Fill out IRS form 1099-NEC

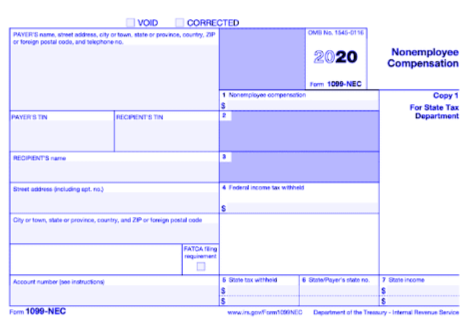

Here is the image of the form for a better understanding of what needs to be filled.

3. There are seven unnumbered boxes that require information about the payer and recipient.

– The first box has to be filled with information about the payer and their business.

-The second box has to be filled with the payer’s tax ID number, such as their Employee Identification Number (EIN).

-The third box contains information about the recipient’s TINs, such as SSS and EIN.

-The next box is where the recipient’s name goes.

-As shown in the picture, the next box is where the street address belongs.

-Furthermore, it should include your city, state, and ZIP.

-Lastly, an account number must be filled in.

4. Now let’s focus on the boxes on the right-hand side.

–Box 1: Total amount of 1099 non-employee compensation. This is the money paid to a non-employee during the year.

–Box 2: If you’ve made direct sales of $5000 or more, enter ‘X’ in the box. You don’t need to write the actual number down.

–Box 3: You needn’t write anything; it is reserved for future use by the IRS.

–Box 4: If you withheld federal income tax during the year, write it down here. This usually happens when the contractor’s TIN is incorrect or an incorrect TIN is written on a W-9 form.

–Box 5: This is where any state tax withheld is mentioned. You can withhold state tax for up to 2 states.

–Box 6: Continuing the form 1099 instructions, this is where you enter the applicable state. You also enter your state identification number here. If you’re mentioning two states, make sure to match up the state’s name and amount neatly.

–Box 7: Enter the amount of state income. It should also be noted that boxes 5-7 needn’t be sent to the IRS. These boxes are for the recipient and state’s purposes only.

5. Submit Copy A to the IRS

Two copies of the form have to be submitted to different parties. Copy A has to be sent to the IRS by January 31st. You can either mail it or send it electronically.

6. Submit Copy B to the Independent Contractor

Based on 1099-NEC instructions, copy B has to be sent to the independent contractor who receives payments.

7. Submit Form 1096

Apart from NEC, you also have to submit form 1096. This is used to summarize the tax returns that are being sent to the IRS. You do not need to send this form to the recipient; it is only sent to the IRS. Moreover, it is only required if you’re filing the 1099 NEC form physically.

The form can be mailed with the other 1099 forms to the IRS. If you’re unsure about the forms and process, various tax services can help!

What Is Considered Non-Employee/Independent Contractor Compensation?

In order to understand how to file a 1099-NEC, you need to be aware of what is considered non-employee, or independent contractor, compensation. While business tax software can help you make this distinction, here are a few examples:

- The most obvious one is any payment made to someone who is not an employee. This is usually made in exchange for services or goods.

- Payments made for services in the course of your trade or business.

- Payments made to an individual, partnership, estate, or corporation.

- Payments that total at least $600 or more for the year.

- Payments are made to an individual with at least $10 in royalties.

- Any federal income tax withheld under backup withholding rules, regardless of the number of payments for the year to the non-employee.

Apart from these situations, there are a few more transactions that require the submission of 1099 NEC forms.

- Fees.

- Benefits.

- Commissions.

- Prizes and awards for services performed by a non-employee.

- Other forms of compensation for services performed for your trade or business by an individual who is not your employee.

What if You Don’t Receive a Form 1099-NEC?

If you’re a contractor, it is the responsibility of the business you work under to send you an NEC form. If they don’t send one, the company will have to face heavy penalties. However, that does not mean you get a pass on your obligations! You should report all your income to the IRS to ensure you do not face any penalties yourself. While there are many tax minimization techniques, you should not omit money earned; take legal steps like tax returns to reduce your taxable income instead.

Make sure to inform the IRS if your form has errors after filing, and what needs to be corrected.

What Are the Penalties of Missing the Deadline for Submitting the NEC Form?

If you miss the window for submitting the new 1099 NEC form, you will face penalties ranging between $50 and $270 per form. If the IRS believes that you skipped out on purpose, you will be charged 10% of your taxable income as a fine. Many tax relief companies can help you in this type of situation, though.

Conclusion

A 1099 form informs the IRS about any additional income apart from your regular salary. It has more than 20 types, with the NEC used for payments made to non-employees. In order to fill out this form, you should collect all the necessary documents to check for accuracy. A copy has to be sent to the IRS, and another to the contractor. If you miss the deadline to submit this form, the IRS will find you, so make sure to get it done!

FAQ

A form 1099 is used to report any additional income apart from the regular salary an individual gets. This form has more than 20 variants depending on the type of income received.

Non-employee compensation is money given to someone who is not an actual employee of a company; instead, they work independently or through a contract. Examples include a lawyer or an accountant.

You can get the form easily on the IRS official website. Simply download the document and follow the form 1099 instructions to fill it out.

![How to Find Someone’s Tinder Profile? [2024 Expert Guide]](https://review42.com/wp-content/uploads/2023/06/Finding-Someone-on-Tinder.jpg)