![2022's CashUSA Review [Features & Criteria]](https://review42.com/wp-content/uploads/2020/12/CashUsa_Logo.png)

- APR RANGE: $5.99 - $35.99

- INCOME THRESHOLD: Varies by lender

- LOAN AMOUNT RANGE: $500 - $10,000

- FUNDING TIME: One business day

- LOAN TERMS: 90 days to 72 months

- REPAYMENT TERMS: Vary by state and lenders

2022's CashUSA Review [Features & Criteria]

Fact-checked

Fact-checked

Last Updated: February 2, 2023

- APR RANGE: $5.99 - $35.99

- INCOME THRESHOLD: Varies by lender

- LOAN AMOUNT RANGE: $500 - $10,000

- FUNDING TIME: One business day

- LOAN TERMS: 90 days to 72 months

- REPAYMENT TERMS: Vary by state and lenders

Best For

Small Loans

STRENGTHS

- Easy to use

- All-online process

- Large lender network

- Fast loan decision

- High level of security

- Disbursement time is as little as one business day

WEAKNESSES

- No direct loans

- Limited loan amount

- No co-funding options

PRICING PLANS:

Monthly

15$/monthly

If you are looking to remodel your home, cover medical costs, mend your vehicle, take out college loans, or you have already maxed out your credit card but still need more, CashUSA reviews deem it as the perfect go-to destination to get a personal cash loan.

In this CashUSA review, you’ll read about features, a loan procedure, terms, and more.

CashUSA Overview

What makes CashUSA.com different from other internet lending companies is that the loans offered by their lender network are smaller, ranging from $500 to $10,000 depending on the lender and the state, and the repayment terms are 90 days to 72 months.

CashUSA is not a loan-providing entity but serves only as a marketplace that attempts to connect consumers to a personal loan provider.

CashUSA Features

CashUSA’s prominent and convenient attributes will help you get a better idea of how it operates and decide whether you see a potential mutual collaboration on the horizon.

Expected Loan Amount

As stated above, approved loan amounts vary from $500 up to $10,000 depending on the lender and the location. Dozens of CashUSA loan requirements reviews confirm it takes only several minutes to know if you qualify for a loan, and as little as a business day to be electronically transferred into your account if approved.

APR

CashUSA does not specify the total annual percentage rate (APR) since it operates as an online loan marketplace, and not a direct lender. The APR depends on the amount of information provided in your loan request, your creditworthiness as well as the state you’re in, and on the lender. The APR for short-term loans ranges from 5.99% up to 35.99%.

Monthly Payment

Once the personal loan is approved and you have received your funds, you may repay the borrowed amount of money with interest (APR) in a specified number of installments over an agreed period, ranging from 90 days to 72 months.

Here’s a representative loan sample from some of the CashUSA installment loan reviews:

| Amount borrowed | Loan term | APR | Monthly payments | Total amount payable |

| $5,000 | 36 months | 18.9% | $179.35 | $6,456.68 |

Loan Term

The loan repayment period on the CashUSA platform runs from 90 days to 72 months. The precise loan terms depend solely on the personal loan provider who gives you a loan offer.

Fees and Penalties

CashUSA charges no fees to complete and submit the online form on their website. However, the incurred costs in interest and fees required by the lenders will be generally higher than the ones incurred when taking out a traditional loan. CashUSA is unable to foresee the exact fees or penalties you will be charged by the lenders.

Fees such as application, prepayment penalty, returned payment fee and late payment fee may apply, however they are entirely at the loan providers’ discretion.

Types of CashUSA Interest Rates

Each individual lender dictates their own interest rate, and CashUSA has no power to influence their decision.

Unsecured or Secured Personal Loans

The lenders in CashUSA’s network offer unsecured personal loans that do not demand any collateral. In case you default on your debt obligations, you will be charged a fee.

Automatic Withdrawal

The lenders in CashUSA’s network offer to set up automatic payments so that you avoid damage to your credit score and late payment fees.

Arbitration

Debt collection arbitration, also known as debt settlement, is a means of settling your unpaid debt. When and how the arbitration process will be set in motion depends on your state and the contract by the lender offering you a loan. This information is often specified in the loan terms and conditions.

Prepayment Penalty

Some lenders may not provide you with the option to pay off the whole borrowed amount at once. If this option is available, charging a prepayment fee in the loan agreement varies from lender to lender. What happens if you pay the entire balance in advance will be stated in your loan agreement.

Fine Print

To avoid signing shady loan agreements that can have serious consequences, CashUSA online reviews highlight the necessity of being able to understand the language of the fine print in your contract. Pay close attention to how much interest rate you will be paying as well as whether the loan you’re getting is a secured loan or an unsecured one. Make sure to ask for clarification or research the terms you do not understand.

CashUSA Mobile App

We cannot provide a CashUSA app review as the company does not currently offer a mobile app.

Approval and Funding Time

Your completed online form will be viewed by lenders in the CashUSA network and you may receive a loan offer from a lender based upon the information you provided. Once you sign the contract, the funding takes as soon as one business day to be transferred to your account.

What Is CashUSA’s Criteria?

The eligibility criteria that a potential borrower must satisfy so that they are able to request personal loans are as follows:

- Be at least 18 years old

- Be a U.S. citizen or permanent resident

- Be employed for at least 90 days and satisfy your lender’s minimal standards for income

- Have a checking account in your name

- Be able to provide work and home phone numbers and an email address

The company might perform a soft credit check to verify your bank information.

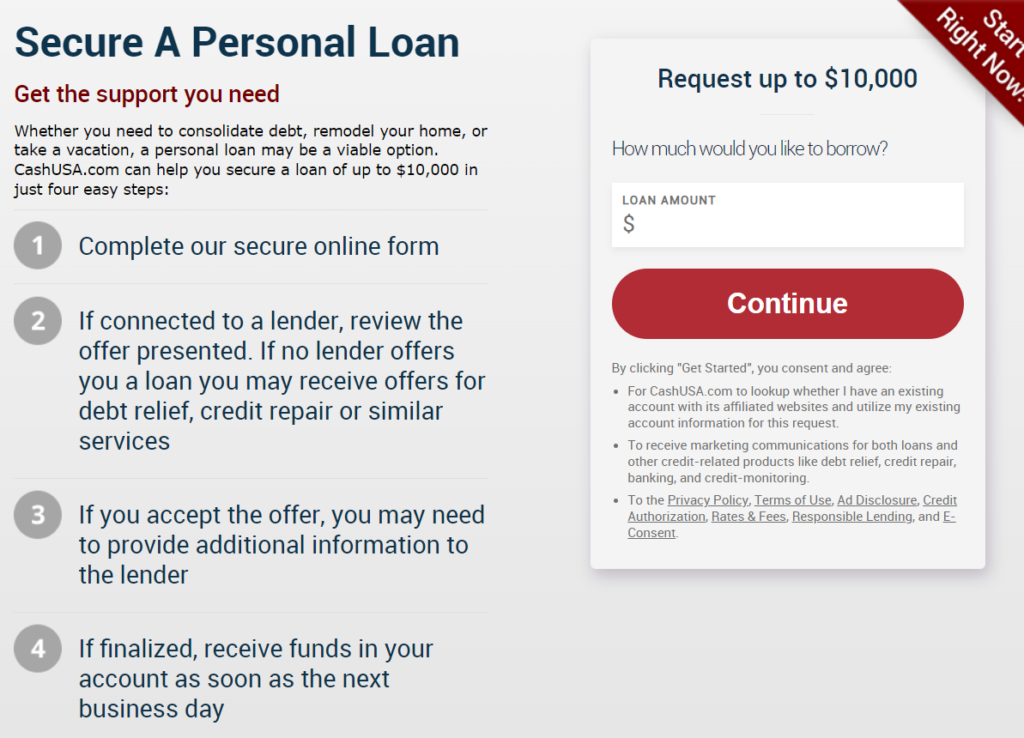

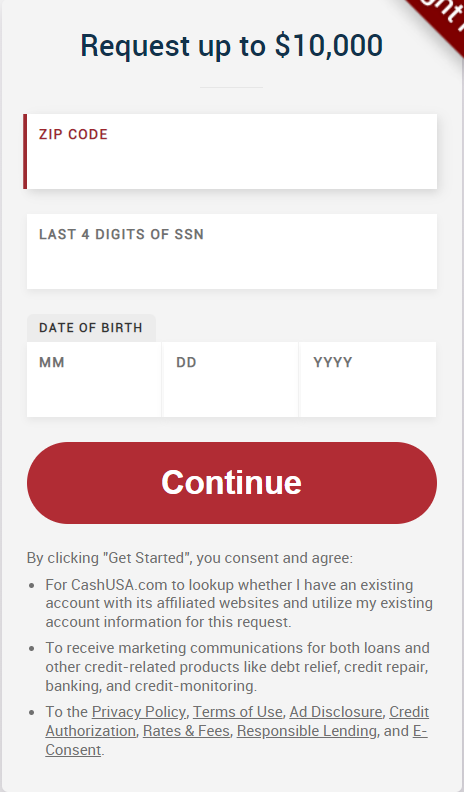

How to Complete the Online Form on CashUSA

Our CashUSA.com review contains step-by-step instructions on how to complete their online form.

Rather than having to shop around and reach out to individual lenders, with CashUSA you submit one online form and see if a lender in their network will offer you a loan.

The online process with CashUSA is straightforward and intuitive as many CashUSA customer reviews say. You are asked to enter basic information to kick off your request.

Here you should enter your loan details and personal information.

The credit type varies from poor (below 500) to excellent (720+). If you don’t know what your credit score is, there are websites that offer free credit reports.

Towards the end of the form, you will also be asked questions that may help your loan get approved.

The lender who offers you a loan will give you a contract to review and sign. The lender may also ask you to send them more information before considering you for a loan.

CashUSA does not charge you to complete their online form. Provided that for some reason no lender offers you a loan on your first try, you are more than welcome to submit another request to see if a different lender can offer you a loan.

Privacy & Security Policy

CashUSA reviews verify CashUSA’s high level of security and privacy regarding personal information collected from both loan customers and website visitors. The third parties with whom they share personal information are lenders, agents of record for lenders, companies offering products connected to your loan request, and other CashUSA marketing partners.

CashUSA Alternatives

There is a wide variety of other online lending facilitators who connect borrowers to lenders with diverse credit profiles. CashUSA does provide a loan within one business day, but there are other companies that provide fast loans, take a look if this company doesn’t have what you’re looking for.

Below, you’ll find tables with details to more easily compare features to CashUSAs’.

|

CashUSA vs. Prosper |

|

| Loan amount | $2,000 up to $40,000 |

| APR range | 7.95% – 35.99% |

| Repayment terms | Monthly |

Prosper is best for people who are looking for small loan amounts.

|

CashUSA vs. PersonalLoans.com |

|

| Loan amount | $500 to $35,000 |

| APR range | 5.99%-35.99% |

| Repayment terms | Depending on lender |

PersonalLoans.com is best for individuals who need to get a loan as soon as possible.

|

CashUSA vs. 5k Funds |

|

| Loan amount | $1,000 – $35,000 |

| APR range | 5.99% – 39.99% |

| Repayment terms | Once/Twice a month |

5k Funds is best for people with a steady income who need a loan, but don’t have a good credit score.

Is CashUSA.com Legit?

After reading our CashUSA review, and perhaps other reviews, you’ll see that this is a viable option for those who desperately need emergency funds since the loan approval time is only one business day. Time is money, and CashUSA can certainly save you time looking for lenders. Also, if you have bad credit, but you want to get a loan, check out our articles and find the companies with the most trusted personal loans for bad credit as well as the companies that guarantee approval even if you have bad credit.

FAQ

Numerous CashUSA reviews have singled out this platform as a top-ranking online lending portal. Its network accommodates multiple lenders with various lending profiles.

Credit history is not a decisive factor for loan approval by the lenders in the CashUSA network. In case no lender offers you a loan, the reason may be due to another reason other than your credit score.

CashUSA does not abuse your personal data. Nevertheless, it is your ultimate responsibility to read the terms, policies, and applicable fees in the loan offers.

Although not accredited by the Better Business Bureau (BBB), their website contains numerous CashUSA reviews, and BBB gave CashUSA a “B” rating.

CashUSA.com reviews deem this company as the best solution for those who are cash-strapped and have no time to apply for a bank loan and await its approval. Even if some people can afford to wait, others may not have their loans approved due to insufficient or bad credit history. Finally, CashUSA loans are suitable for people with little financial literacy as completing the online form is quite simple according to CashUSA reviews.