![2022's Robinhood Review: [Is It Legit?]](https://review42.com/wp-content/uploads/2022/02/logo_Robinhood.png)

- Trade Commissions: ★★★★★ 5/5

- Margin Rates: ★★★★★ 5/5

- Miscellaneous Fees: ★★★★☆ 4/5

- Offering of Investments: ★★★☆☆ 3/5

- Customer Service: ★★★☆☆ 3/5

- User Experience: ★★★★★ 5/5

- Trading Platforms and Tools: ★★★★☆ 4/5

- Research: ★★★★☆ 4/5

- Education: ★★★★☆ 4/5

2022's Robinhood Review: [Is It Legit?]

Fact-checked

Fact-checked

Last Updated: February 2, 2023

- Trade Commissions: ★★★★★ 5/5

- Margin Rates: ★★★★★ 5/5

- Miscellaneous Fees: ★★★★☆ 4/5

- Offering of Investments: ★★★☆☆ 3/5

- Customer Service: ★★★☆☆ 3/5

- User Experience: ★★★★★ 5/5

- Trading Platforms and Tools: ★★★★☆ 4/5

- Research: ★★★★☆ 4/5

- Education: ★★★★☆ 4/5

Best For

Trading without a commission

STRENGTHS

- Beginner-friendly and easy to use

- Free or exceptionally low trading costs

- Handy features for cash management and recurring investments

WEAKNESSES

- Has been involved in questionable events the last few years pertaining to allegedly misleading customers

- A lack of investment options

Robinhood has no doubt caught your eye with its claim to be a no-commission trading platform, but it’s reasonable to wonder if it’s too good to be true. In this Robinhood review, we’ll let you in on everything you need to know about this trading platform, including features, ease of use, pricing and fees, etc.

What Is Robinhood and How Does It Work?

As Robinhood proudly states, its mission is to “democratize finance for all.” This is backed up by offering zero-commission trading on the platform, which means it doesn’t directly take any additional fees for allowing you to trade via its exchange.

Although this may sound too good to be true, the company openly explains how does Robinhood work and how it earns money, citing multiple revenue streams such as rebates from market makers on user transactions, Robinhood Gold, margin trading, cash management fees, income generated from cash, and more.

The point is that it doesn’t cost the user anything to trade stocks, an ETF, or anything else using Robinhood. What’s more, Robinhood will give you 1 free share of stock from high market cap companies if you link your bank account and fulfill the promotion requirements.

| NOTE: Robinhood was fined $65 million by the Securities and Exchange Commission for allegedly misleading customers about its business, and $70 million by FINRA for a number of other failings. |

Main Features

In my Robinhood investing review, I was surprised with the number of trading features Robinhood has to offer—as a no-commission platform, I expected it to be very basic. However, the platform supports a huge number of trading instruments and types, as well as various tools to manage your trades and make informed decisions.

From futures trading to crypto, it’s a great across-the-board trading solution.

Stock Trading

Robinhood enables trading of over 5,000 different stocks, including most US equities and exchange-traded funds (ETFs) listed on US stock trading exchanges. However, you can also take part in international trading of 250 stocks listed as American Depositary Receipts (ADRs), including shares in companies like Adidas (ADDYY), Tencent (TCEHY), and Nintendo (NTDOY).

Fractional Shares

Another useful feature I uncovered in my Robinhood trading review was that you can trade using fractional shares. Robinhood allows you to trade fractions as small as 1/1000000 of a share. You can trade most stocks with shares over $1 and a total market cap of $25,000,000 as fractional shares.

Banking

You can link your bank account(s) for fast and secure transfers via the Robinhood app or website. Robinhood has built-in support for major banks like Wells Fargo, Bank of America, or Chase. You can also manually link smaller accounts by just providing your routing number and bank’s info.

Options Trading

No Robinhood investing review is complete without looking at its options trading features. With Robinhood’s options trading, you can open Good-til-Canceled versus Good-for-Day trades. The former are options that will stay open for up to 90 days after buying a stock, while the latter will automatically close at the end of the trading day. However, your trading options are limited based on your trading level.

Options Exercising

Robinhood will always automatically exercise your option trade for you if they’re eligible upon expiration, meaning you have the buying power to exercise the share and that it’s “in the money.” Although you can also manually exercise options at any time from the web or app interface, it’s this level of automation that stands out in most Robinhood reviews.

DRIPs

Short for dividend reinvestment, this feature will automatically reinvest your dividends as an investor back into stock. You can enable/disable this feature in the dashboard. Only certain stocks are eligible for dividend reinvestment, but it’s a handy feature if you want to invest in stocks long-term.

Crypto Trading

Launched a few years back, Robinhood’s Crypto trading enables you to buy and sell crypto with 0% commission. Currently, Robinhood only supports trading 7 of the largest cryptocurrencies, including Bitcoin (BTC), Dogecoin (DOGE), Litecoin (LTC), Ethereum (ETH), Bitcoin Cash, etc. If you’re already using it, it’s great for learning how to trade crypto.

No Inactivity Fees

Many an alternative to Robinhood, particularly the low-cost ones, will encourage you to use it as an active trading platform by charging inactivity fees. However, true to their motto, Robinhood doesn’t take part in these practices, which is great if you merely want to watch the markets and bide your time or hold certain shares long-term.

FINRA Member

Robinhood is a registered member of Financial Industry Regulatory Authority (“FINRA”), a US regulatory body that ensures safe and fair trading practices. Apart from being a voluntary member of this body, it’s also registered with the SEC (Securities and Exchange Commission). However, we’d be remiss in our Robinhood broker review if we didn’t point out it was recently heftily fined by both these regulators.

Web Trading Platform

While researching Robinhood, I was immediately impressed with how feature-rich the web trading platform was. It provides almost all the instrumentation and charting tools you need to analyze the financial markets and make informed decisions, as well as use a variety of trades with basic rules. While Robinhood may still not be really suitable for expert traders, it’s a great way to get a start in the trading game.

Stock Research

Another way how to use Robinhood is as a paid member. Robinhood provides Gold plan members with access to expert stock research from Morningstar, an independent group of financial service providers for professional-level market research, analysis, and advice to everyday investors. Morningstar regularly publishes reports and sends out stock alerts whenever it has significant research results to share.

Mobile Trading

Aside from the website, you can also access the Robinhood trading platform via their mobile apps for Android and iOS. A common complaint in almost any Robinhood app review is that it uses a gamified approach that encourages activity, which some claim can lead to bad trading behavior, although it’s up to the individual. Also, ratings for the iOS app are much higher at 4.2 than for Android at 3.8.

Options Chains

An option chain is a listing of all available option contracts, and you can find out more about what options are in our guide. Robinhood provides a table with all the put and call values for options, giving you a quick overview of all the available options for a stock that would usually take a long time to find and make a decision on.

| Feature | Rating |

| Stock Trading | ★★★★★ 5/5 |

| Fractional Shares | ★★★★★ 5/5 |

| Banking | ★★★★★ 5/5 |

| Options Trading | ★★★★★ 5/5 |

| Options Exercising (Web) | ★★★★★ 5/5 |

| DRIPs | ★★★★☆ 4/5 |

| Crypto Trading | ★★★★☆ 4/5 |

| No Inactivity Fees | ★★★★★ 5/5 |

| Member FINRA | ★★★★★ 5/5 |

| Web Trading Platform | ★★★★★ 5/5 |

| Research – Stocks | ★★★★☆ 4/5 |

| Mobile Trading | ★★★★☆ 4/5 |

| Option Chains – Streaming | ★★★★☆ 4/5 |

Ease of Use

Now, we’ll dive into our Robinhood trading app review to see how easy it is to use the platform. First of all, you can choose whether to trade via the web interface or mobile apps.

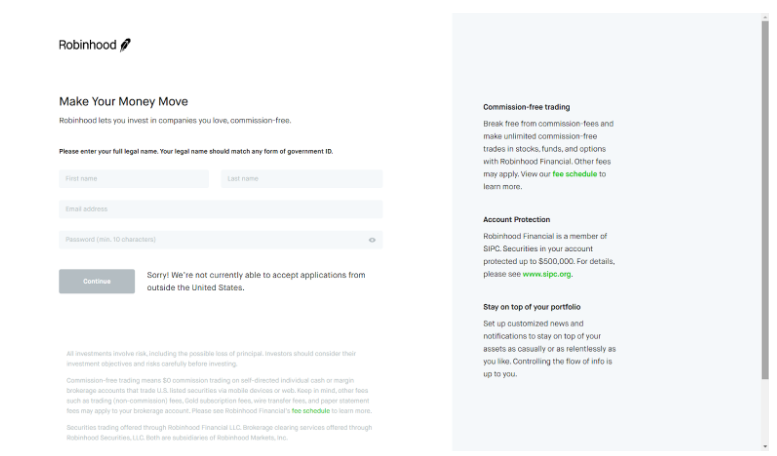

Either way, the signup is quick and easy, as long as you meet the requirements:

1. First, go to the Robinhood site and click any of the Sign Up buttons.

2. You’ll then have to provide some basic information to register an account:

3. After this, you’ll need to go through an application process that involves verifying your identity. Reviews on Robinhood say this could take up to five working days, which is pretty standard for reputable financial services. As part of the application, you’ll need to provide your tax ID and financial details as well as your SSN (Social Security Number). As of now, Robinhood is still only available for users in the US.

Unlike with some Robinhood competitors, it’s very quick and simple to link a bank account and start moving funds in and out of your Robinhood account. The app also provides helpful hints to kickstart your first few trades. The overall user experience is great, although the Android app does suffer from occasional bugs.

Plans, Pricing, and Contracts

As part of Robinhood’s pledge to “democratize finance,” it’s a free-to-use platform that charges no commissions. However, you can pay for some extra benefits:

| Plan | Price+Subscription | Features |

| Robinhood Gold | $5/month | -Access research reports and market data

-Borrow at 2.5% interest -Margin investing -Larger instant deposits ($5,000–$50,000) |

| Robinhood Cash Management | $0 | -Robinhood debit card

-Receive paycheck, pay rent, spend in-store or online -Earn up to 0.3% APY |

Although Robinhood claims to offer “no-free” trading, there are certain fees applicable for other actions or imposed by third parties. You can find the entire fee schedule here.

You also get a free share when you sign up and link a bank account. While we can’t do a full Robinhood free stock trading review here, it’s another great reason to at least try the platform.

For example, there’s a regulatory trading fee of $5.10 per $1,000,000 as well as a TAF of $0.000119 per share (equity sells) and $0.002 per contract (options sells) up to $5.95.

That being said, Robinhood itself charges no fees for any type of trading, whether it’s stocks, futures, forex trading, or for using their cash management platform.

Customer Support

Robinhood provides a huge amount of information in the form of a learning portal and knowledge base. However, as one of the worst aspects of the Robinhood platform used to be the lack of in-person support, it recently introduced a 24/7 phone line alongside chatbot support. While it’s improving, Robinhood customer service reviews still give it a very low score of 1.1 on Trustpilot.

Robinhood Alternatives

Let’s see how Robinhood compares to some of its competitors:

| Win | Lose | Best for | |

| Robinhood vs Acorns | Robinhood offers free investing with minimal additional fees. | Acorns is a safer and less hands-on way to start investing. | Hands-off investors looking for an easy way to build saving habits with cashback rewards. |

| Robinhood vs TradeStation

Read the full review of TradeStation. |

Robinhood offers lower fees and margins in general. | Robinhood isn’t available on as many platforms as TradeStation, and doesn’t have a desktop trading platform. | More investment options for mutual funds and other trading opportunities. |

Clearly, Robinhood is still the undisputed king of low-cost trading. Not only is it a commission-free platform, but its spreads, margins, and transaction fees that do apply are generally much lower.

Is Robinhood Worth it?

Yes, at almost no cost to you, there’s really no reason not to try Robinhood if you’re still learning how investing in stocks works. In our Robinhood review, we felt that it blends ease-of-use with the necessary tools and capabilities to appeal to complete newbies and seasoned traders alike, not to mention no fees and low minimum account balances.

Robinhood is truly an accessible and beginner-friendly platform for any trader looking to start trading crypto, stocks, or other instruments at next to no cost.

FAQ

Once you link your bank account, you can withdraw funds from Robinhood in just a few clicks. You can make up to 5 withdrawals a day of up to $50,000 in value, although deposits can take up to 5 days to complete.

The main way to make money on Robinhood is to take part in trading stocks, EFTs, options, symbols, crypto, and other assets. However, you can also earn interest by using their cash management services.

Crypto trading works just like trading anything else on the Robinhood platform. Currently, Robinhood supports 7 cryptocurrencies, including Bitcoin, Dogecoin, Ethereum, and Litecoin. Robinhood’s no-fee policy also applies to crypto trading.

For the most part, yes. However, you’re solely responsible for taking risks and making good financial decisions using the platform. Robinhood has also been fined for misleading customers on at least two high-profile occasions, although some digging in our Robinhood review points to these being isolated incidents.