![Ellevest Reviews [Features, Pricing & Alternatives]](https://review42.com/wp-content/uploads/2022/07/ELLEVEST-LOGO-e1657105431151.jpg)

- Account Minimum: ★★★★★ 5/5

- Account Management Fee: ★★★★★ 5/5

- Investment Expense Ratios: ★★★★★ 5/5

- Human Advisor Option: ★★★★☆ 4/5

- Portfolio Mix: ★★★★☆ 4/5

- Socially Responsible Portfolio Options: ★★★★☆ 4/5

- Accounts Supported: ★★★★★ 5/5

- Tax Strategy: ★★★☆☆ 3/5

- Automatic Rebalancing: ★★★★★ 5/5

- Customer Support Options: ★★★★☆ 4/5

Ellevest Reviews [Features, Pricing & Alternatives]

Fact-checked

Fact-checked

Last Updated: February 2, 2023

- Account Minimum: ★★★★★ 5/5

- Account Management Fee: ★★★★★ 5/5

- Investment Expense Ratios: ★★★★★ 5/5

- Human Advisor Option: ★★★★☆ 4/5

- Portfolio Mix: ★★★★☆ 4/5

- Socially Responsible Portfolio Options: ★★★★☆ 4/5

- Accounts Supported: ★★★★★ 5/5

- Tax Strategy: ★★★☆☆ 3/5

- Automatic Rebalancing: ★★★★★ 5/5

- Customer Support Options: ★★★★☆ 4/5

Best For

Robo-advisory, investment, and financial planning

STRENGTHS

- Purchasable 1-on-1 financial and career coaching sessions

- There are no minimum financial requirements

- Ellevest memberships start at just $1/month

WEAKNESSES

- A lack of advanced tax and investment features

- IRA planning isn’t available for Essential users

Ellevest is a robo-advisory, investment, and financial planning platform with a strong focus on ESG and women-related investments. However, Ellevest is open to all, and anyone looking for a way to kickstart their savings or investments is welcome to use its services. To help you decide if it’s the right platform for your goal planning, in this review we’ll look at Ellevest reviews, features, pricing, support, and alternatives.

What Is Ellevest and How Does It Work?

In part thanks to venture capital provided by Melinda Gates’ Pivotal Ventures, Ellevest was co-founded by Sallie Krawcheck and Charlie Kroll in 2014 with the goal to address the gender money gap and primarily cater to aspiring female investors. All the platform’s financial advisors and coaches are also female.

That being said, anyone can register an Ellevest account, including men and those identifying as non-binary. Today, Ellevest has over $1 billion in assets under management and a community of over 3 million. It’s even been named the #1 “Mission-Oriented Investing Service” by Bankrate.

Main Features

Part of Ellevest’s charm is that it’s actually a very straightforward platform that takes its fiduciary responsibilities seriously, limiting its users’ freedom to make their own investment decisions by offering safe and stable investment management options instead.

Most Ellevest reviews either complain about this simplicity or praise it, depending on who you’re recommending it to.

Stock and Options Trading

Unfortunately, Ellevest doesn’t allow manual stock or options trading on its platform—as a fiduciary service, it tries to shy away from risky endeavors such as day trading.

Coaching

Aside from being a robo investment advice platform, one of the things that makes Ellevest so attractive is that it provides one-on-one financial coaching sessions with a vetted financial professional. The 50-minute sessions are either career or money-related, covering areas such as debt management, budgeting & spending planning, career clarity, and even homebuying.

Although you can actually buy a coaching session without an Ellevest membership, members enjoy significant discounts.

These optional one-on-one coaching sessions are a key differentiator when looking at how does Ellevest work compared to other robo-advisors. If you’re unsure which session to choose, you can even book a free 15-minute call and get advice from an Ellevest representative.

Investment

The primary vehicle you’ll use to invest with Ellevest are investment portfolios designed by the Ellevest team. Ellevest strongly believes in the diversification and stability exchange-traded funds (ETFs) and mutual funds offer their users.

Depending on which reviews of Ellevest you look at, this is either the platform’s biggest pro or con, particularly as there’s no personalized portfolio option.

Nevertheless, Ellevest has a point in that investing in a single stock is quite risky, as it means you’ll lose a lot of money if it underperforms or fails. ETFs and mutual funds, on the other hand, rely on the majority of their stocks performing to keep your overall portfolio healthy and growing.

You can choose between two investment products: Core and Impact.

While Core maximizes tax benefits and diversification, Impact invests the majority of your shares in ESG (socially-responsible portfolio options) and impact funds, which are stocks of companies that have a positive impact on the environment or women’s empowerment.

The internal expense ratio for the Core plan is between 0.06%–0.23% and between 0.12%–0.26% for the Impact plan. While not the lowest, these are pretty decent investment expense ratios, and Ellevest investors also benefit from continuous auto-optimization and automatic rebalancing.

Accounts Supported

Aside from an investment portfolio mix, Ellevest also offers spending and savings accounts with an associated debit card. You can move your money freely between your spending and savings account with no account minimums, which is a fan-favorite feature according to Ellevest financial reviews.

By spending with your Ellevest debit card, you’ll earn an average of 5% in cashback rewards on all your daily spending.

Using the spare-change savings feature, Ellevest will round up all transactions to the nearest dollar and transfer the change to your savings account. However, the Ellevest savings account unfortunately doesn’t earn any interest, but you can use these banking services with no overdraft, account, or transaction fees. All accounts are also FDIC-insured up to $250,000.

Retirement Planning

You can choose to move your IRAs, 401(k), or 403(a) plans over from your current provider to Ellevest. Ellevest invests retirement savings in Roth IRAs, allowing you to withdraw contributions at any time without penalty. You can also withdraw earnings after 5 years if you have a good reason to do so. However, when you compare Personal Capital vs Ellevest, Ellevest’s retirement plans and tax strategies aren’t nearly as advanced.

| Feature | Rating |

| Stock and Options Trading | ☆☆☆☆☆ 0/5 |

| Coaching | ★★★★★ 5/5 |

| Accounts Supported | ★★★★☆ 4/5 |

| Investment Types | ★★★★☆ 4/5 |

| Retirement Planning | ★★★★☆ 4/5 |

Ease of Use

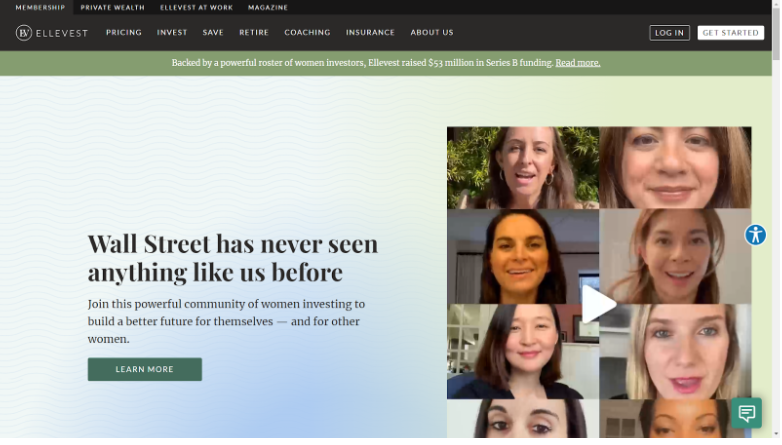

As Ellevest claims its whole mission is to make investing and financial planning quick and easy for women, we really wanted to use our Ellevest review as an opportunity to see if this is really the case.

Below, you can find the step-by-step process of what it takes to get started with Ellevest:

1. Go to Ellevest.com and click any of the “Get Started” buttons:

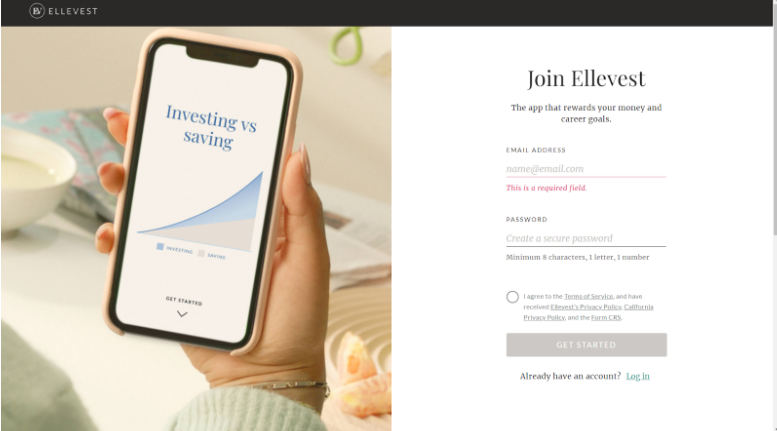

2. Next, you’ll create an account simply by providing an email and password:

3. Ellevest will then take you through a quick-step guide explaining how the platform works:

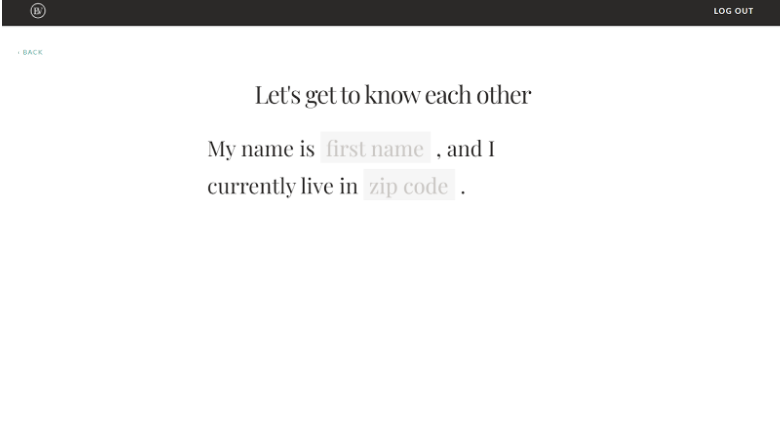

4. Now, Ellevest will try to find out more about you and your goals to tailor its investing advice. Just fill in the blanks to continue:

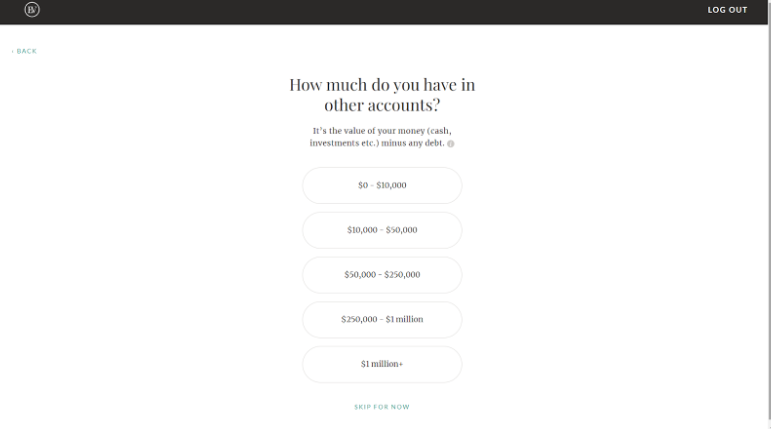

5. After this, you’ll answer another short series of questions to determine your exact reasons for using the app, most of which are skippable:

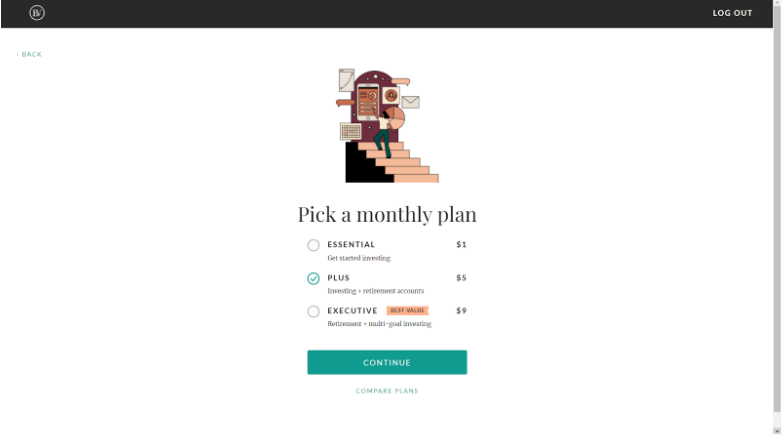

6. You can then choose your subscription plan:

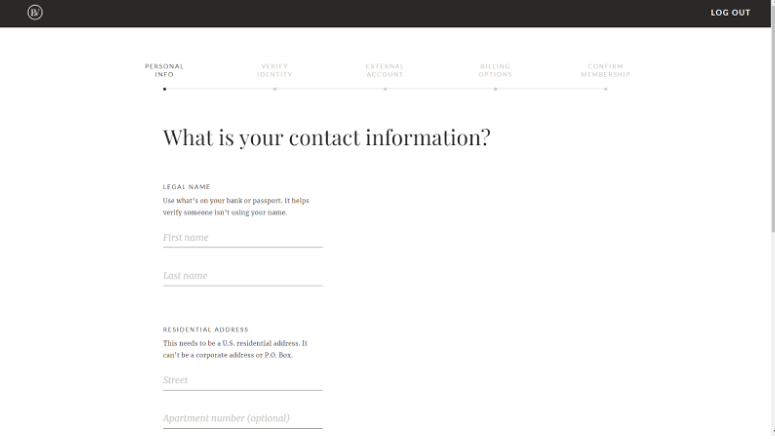

7. The final stretch of the process is to confirm your personal information:

One of our few Ellevest complaints is that the signup process can feel quite long and drawn out, but that’s to be expected from a financial service like this to do their due diligence.

Even after everything, you’ll still need to verify your residential address and nationality as well as link an external bank account so you can deposit funds into Ellevest (via Plaid). Keep in mind that Ellevest only allows U.S. citizens and foreigners with residential status to use the platform, and you also need a U.S. bank account to link to Ellevest.

Once you complete these steps, you’ll once again be given the opportunity to confirm your membership. Then, you can purchase your Ellevest subscription and log into your dashboard.

Plans & Pricing

As a financial planning app, the cost of using it is even more relevant when asking yourself: Is Ellevest worth it? Ellevest offers a relatively simple and transparent range of pricing plans for potential investors with different goals:

| Plan | Price | Features |

| Essential | $1/month ($12/year) |

|

| Plus | $5/month ($54/year) |

|

| Executive | $9/month ($97/year) |

|

As you can see, all Ellevest plans are pretty affordable—starting at just $1/month, the Essential plan costs next to nothing but comes with all the most essential features for most beginners. Since Ellevest doesn’t offer a free trial or money-back guarantee, it’s the perfect way to get to grips with the platform without risking a significant amount of money.

Few—if any—Ellevest competitors can match this low entry-level pricing.

Relatively speaking, Plus costs much more than Essential, but it’s still insanely cheap and comes with the most significant annual fee discount of 25% for Ellevest users who want to start their long-term retirement planning and enjoy slightly higher discounts for one-on-one coaching.

The top-tier Executive plan costs nearly double what Plus costs, but it’s still a stretch to consider it expensive. This plan comes with significant coaching discounts, so it’s perfect for those who want to take full advantage of one-on-one financial planning. If you’re more experienced and confident in the Ellevest platform, being able to set up multiple investing goals is also really attractive.

Remember that you can also purchase individual 1:1 coaching sessions from Ellevest. Although there are pricier sessions, they typically cost between $149 and $299 per 50-minute session, depending on whether you’re a member.

Customer Support

Most Ellevest customer reviews on Trustpilot are positive, with only the odd complaint. For most support queries, you’ll have to make do with just the automated chat feature, but premium members can reach out to the concierge team for help with billing or other issues.

Ellevest Alternatives

Here are some of the main Ellevest alternatives you may want to consider:

| Wins | Loses | Best for | |

| Ellevest vs Betterment

For a full review of Betterment, click here. |

Ellevest provides better diversification by including mutual funds and REITs in its portfolios. | Betterment allows you to track your total worth across external accounts as well. | Those who want to invest less than $50,000. |

| Ellevest vs Acorns

For a full review of Acorns, click here. |

Ellevest provides access to a human advisor option through 1:1 coaching sessions. | Acorn offers an exceptionally user-friendly experience. | Those struggling to save who want a beginner-friendly app. |

| Personal Capital vs Ellevest

For a full review of Personal Capital, click here. |

Ellevest has no minimum requirement while Personal Capital requires a minimum $100,000. | Ellevest doesn’t offer advanced investment management features such as tax-loss harvesting or trust accounts. | High-income investors who want advanced tax and investment tools. |

Of course, the most significant distinguishing feature of Ellevest is that it’s a women-focused investment management platform, which means it tailors its investment advice to the unique challenges and opportunities faced by women.

Other than that, it has a lot in common with other top robo-advisors and goal planning services, but one thing it offers that many don’t is the ability to purchase 1:1 advisor access for career or financial planning.

Is Ellevest Worth It?

Starting at just $1/month, Ellevest is definitely worth a try for anyone new to investing or financial goal planning. Thanks to its easy-to-use linked savings and spending accounts, it can be a convenient platform to handle almost all your finances. Plus, if you’re ever unsure of what’s the best move for you, you can link up with a professional financial coach for a 1-on-1 session.

Ellevest is a convenient platform for beginners when it comes to financial goal planning and investment with a women-first approach.

FAQ

Yes, Ellevest is a legit robo-advisory and investment planning platform that’s been in business since 2014, and has a solid track record without any major incidents.

No, men and non-binary individuals can also sign up for Ellevest and use all of its services. Ellevest is just a women-focused platform aimed at helping address issues such as the gender money gap. Some of its investment advice is also tailored to women, but anyone can benefit from them, as you can see from Ellevest reviews.

Ellevest makes money primarily off of its membership plans, as itt doesn’t charge any additional account, transaction, or AUM fees. Ellevest also makes money from its coaching and Private Wealth Management services.

Ellevest’s membership plans cost $1, $5, and $9 per month respectively. However, Ellevest doesn’t charge any account, transaction, or management fees for banking or investment users. Nevertheless, coaching sessions usually cost between $149 and $299 for 50 minutes.