- Account Minimum: ★★★★★ 5/5

- Account Management Fee: ★★★★☆ 4/5

- Investment Expense Ratios: ★★★☆☆ 3/5

- Human Advisor Option: ★★☆☆☆ 2/5

- Portfolio Mix: ★★★☆☆ 3/5

- Socially Responsible Portfolio Options: ★★★☆☆ 3/5

- Accounts Supported: ★★★☆☆ 3/5

- Automatic Rebalancing: ★★★★★ 5/5

- Customer Support Options: ★★★☆☆ 3/5

Acorns Review: Features, Pricing, More

Fact-checked

Fact-checked

Last Updated: February 1, 2023

- Account Minimum: ★★★★★ 5/5

- Account Management Fee: ★★★★☆ 4/5

- Investment Expense Ratios: ★★★☆☆ 3/5

- Human Advisor Option: ★★☆☆☆ 2/5

- Portfolio Mix: ★★★☆☆ 3/5

- Socially Responsible Portfolio Options: ★★★☆☆ 3/5

- Accounts Supported: ★★★☆☆ 3/5

- Automatic Rebalancing: ★★★★★ 5/5

- Customer Support Options: ★★★☆☆ 3/5

Best For

Investment management solutions

STRENGTHS

- Useful spare-change savings with Round-Ups

- Cashback benefits from selected retailers

- Suitable for beginners

- Family investment options available

WEAKNESSES

- Small account balances liable to incur heavy fees

- No tax strategy such as tax-loss harvesting

We all have good intentions of saving money for a rainy day. However, doing so is not always easy or financially viable. This is where Acorns.com comes into play.

This Acorns review looks at what Acorns is and what you stand to gain from using its services.

What Is Acorns And How Does It Work?

Acorns is essentially an investment management solution. It provides a platform for micro-investment by rounding up your transactions made via debit or credit card to the nearest dollar. The spare-change savings are then invested on behalf of the account holder.

Acorns’ socially responsible portfolio options are built by experts. As such, users are guaranteed at least a limited investor assessment. Still, determining the amount of risk you are willing to incur lies solely with the account holder.

So, if you battle to stick to a savings plan or have a hands-off approach to investment, this review of Acorns is for you. For a more active approach to money matters, research Stash savings.

| NOTE: Advanced technology used by top-of-the-line robo advisors can maximize the auto-optimization of your investments. |

Main Features

Acorns specializes in account management to benefit the bottom line. It is also particularly useful to beginners trying their hand at understanding finance and learning the basics.

Features include:

Acorns App

The Acorns app gives users one-page access to investing, boosting retirement savings, and investing for kids.

Investing and Earning

1. Invest: Access to Personal or Family Acorns accounts allows for the activation of the Round-Ups feature. Set preferences for spare change to be invested in an ETF portfolio mix. Refer to reviews on Acorns investment portfolios for clarity on core and sustainable investment options and the associated risks.

Acorns automated financial advisors on the app ensure that when account rebalancing occurs the investment targets are aligned and internal expense ratios are updated.

2. Later: Invest for retirement with IRAs, Roth IRAs, or SEP plans.

| NOTE: Recent developments within the company allow for a more personalized portfolio with 10%-20% of individual investment choices permissible. |

3. Early: Acorns Early, available on the Family pricing plan, permits multiple junior users investment with custom diversification recommended by robotic advisor access.

4. Enjoy automatic rebalancing of your portfolio without the need to invest your time.

5. Earn bonus investments when shopping with Acorns’ partners such as Nike, Macy’s, Walmart, and Hotels.com. Our review of Acorns investment benefits shows that details can be found when downloading the app or installing Safari and Chrome extensions on Google Chrome.

6. Invite a friend for an extra $5 investment or benefit from monthly referral bonuses. Bonus payouts process in 60-120 days.

7. Invest in Bitcoin or its fractional shares.

Banking

An Acorns checking account with a heavy metal debit card activates automatic investment of a portion of every salary payment received, (Smart Deposit) with the Round-Up feature standard.

If you prefer, deposits can be directed into your Acorns checking account to allow for salary payments to be available as much as 2 days earlier than usual.

The Acorns Spend review links this account to investment and retirement savings on the platform.

Additional Details

- FDIC-insured for up to $250,000 + fraud protection

- Fee-free ATMs inclusive

- Contrary to similar investment apps, Acorns does not charge low balance/overdraft fees or commission

- Acorns does not manage Thrift Savings Plans or 401(k) accounts but allows for them to be converted into an Acorns Later IRA account

- Acorns does not provide tax strategies. However, be sure to include dividends and interest in your tax return to prevent triggering an investment expense audit of your accounts.

Resources and Education

Acorns users are given access to financial knowledge sponsored by Acorns in conjunction with CNBC. The content supplied is compiled by financial experts.

Acorns Review Ratings

| Feature | Rating |

| Minimum Investment | ★★★★★ 5/5 |

| Account Fees | ★★★★☆ 4/5 |

| Mobile Access | ★★★★★ 5/5 |

| Website Access | ★★★★★ 5/5 |

| Accounts Supported | ★★★★☆ 4/5 |

| Money Market | ★★★☆☆ 3/5 |

| Savings | ★★★★☆ 4/5 |

| Checking | ★★★★★ 5/5 |

| Customer Service | ★★☆☆☆ 2/5 |

Ease of Use

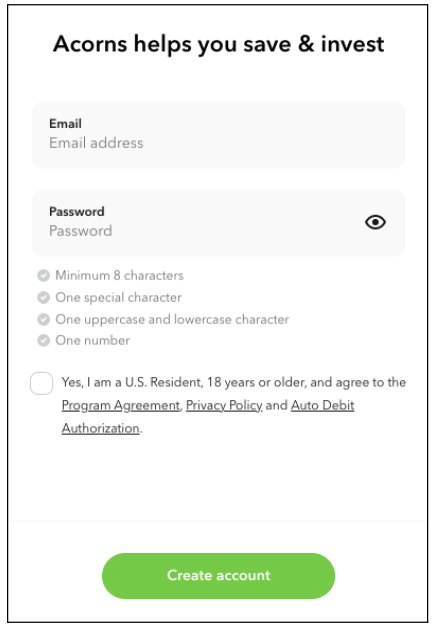

1. To sign up to Acorns:

2. Click on the Get the app button.

Alternatively, select the payment option you prefer and start from there.

Next, you’ll see the following screen:

4. Complete required fields and click Create Account.

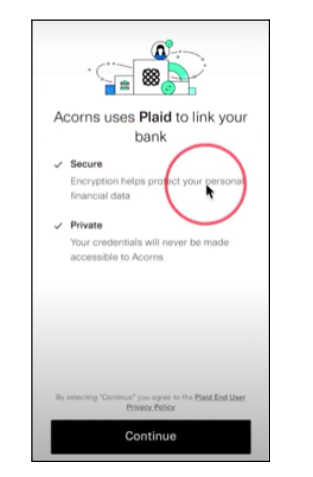

5. Next, link your account to your bank account or Acorns checking account to activate Round-Ups.

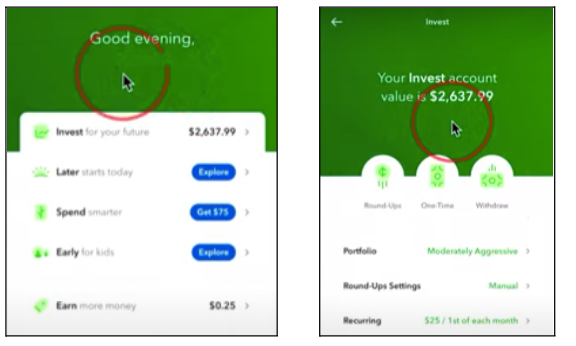

6. Access your account homepage. Click on Invest for Your Future to access the investment options. Your investment will read $0.

7. Click on Round-Ups to personalize your settings.

| NOTE: We concur with Acorns customer reviews that customizing the settings is made easy by the site’s straightforward, easy-to-navigate interface. |

Examples of what you can do include:

- Set to automatic

- Add a multiplier for faster savings growth

- Link accounts

8. Once you’ve clicked on Link an Account, you can search for your bank in the dropdown list.

9. Click on your bank and follow prompts to log in to your bank account.

| NOTE: Acorns uses the highest security measures, including SIPC protection, FDIC insurance, SSL encryption, 2-factor authentication, automatic logouts, and ID verification to prevent unauthorized access to the accounts. Withdrawal alerts are also included. |

10. Toggle to allow transfers.

11. Save the updates.

12. If preferred, set up One-Time Investments next (or alternatively set up Recurring Investment).

13. Additional settings to customize:

- Earn from partners

- Access for cashback options

- If you still wonder, how does Acorns work, access the knowledge bank

- Set up for kids investments

- Complete details on portfolio and upload ID photo for identity verification if prompted

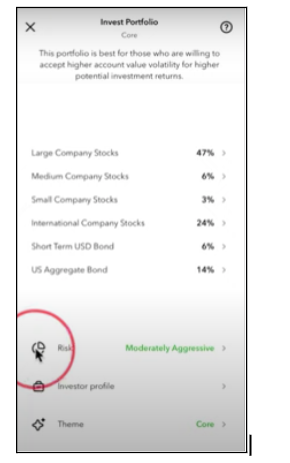

14. Select the type of investment risk preferred:

- Moderately conservative: 40% stocks + 60% bonds

- Moderate: 60% stocks + 40% bonds

- Moderately aggressive: 80% stocks + 20% bonds

- Aggressive: 100% stocks

Plans & Pricing

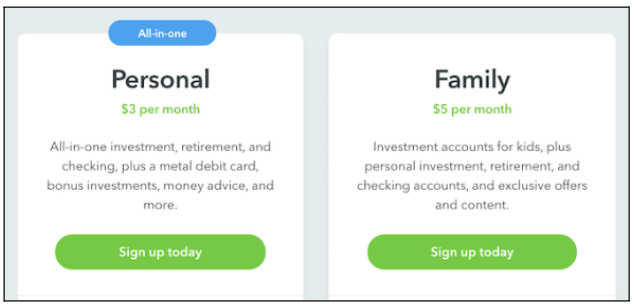

Acorns benefits and rewards are accessible from the dedicated Acorns app. Select one of the following prescription tiers to start:

| Plan | Price |

| All-in-one Personal | $3 / month |

| Family | $5 / month |

All-In-One Personal Plan

When researching for our Acorns investing review, we found this plan to be affordable to accommodate tight budgeting. Benefits include an investment account with Round-Ups, up to 10% bonus investments, and savings to launch retirement plans with potentially lucrative tax advantages.

Users can opt to link to an Acorns checking/investment account for additional advantages.

Family Plan

In addition to all the benefits of the Personal Plan, this tiered option includes an additional early investment account for kids.

Benefits include:

- Multiple users at no extra cost

- Automatic recurring investments

- Financial education

- Exclusive bonus investment opportunities

- Potential tax savings

| NOTE: If your Acorns investment portfolio balance exceeds $5,000, you are eligible to be charged a 0.25% annual fee. Investment expense ratios apply. |

Customer Support

Almost every Acorns IRA review we consulted stated that Acorns support teams are available 24/7 on their Help Center website. Additionally, users are advised to phone (855)739-2859 if they want access to a human advisor option or to click on Contact Us on the FAQ page.

However, the service seems to be outsourced and reviews on Consumer Affairs and Trustpilot rate customer support to be quite unsatisfactory and unresponsive.

Acorns Alternatives

There is a selection of viable Acorns alternatives available.

Acorns vs Betterment

While Acorns is undoubtedly the better option for beginners who want to save money, Betterment has a better portfolio selection and offers high-yielding savings options.

On the other hand, Betterment charges a 0.25% – 0.40% management fee and does not give the option to round up change for additional savings. It’s more expensive than Acorns, although Acorns account holders with small balances may disagree.

Read the full review of Betterment here.

Acorns vs Stash

Both these platforms focus on beginner investors. However, whereas Acorns robo advisors select portfolio content exclusively, Stash allows for a more hands-on approach and provides you with opportunities to learn how to invest.

Acorns vs Robinhood

Acorns and Robinhood look similar with regard to their trading cost and account minimum requirements. However, Robinhood allows mobile users to manage personalized investment portfolios themselves, with priority advisor access on Gold Accounts.

Read the full review of Robinhood here.

| Feature | Acorns | Stash | Betterment | Robinhood |

| Hands-On Investment | No | Yes | Yes | Yes |

| Round-Ups | Yes | Yes | No | – |

| Sustainable Portfolios (SRI) | 1 | 0 | 3 | No |

| Minimum Investment | $5 | $5 | $10 | $0 |

| Management Fee | $3 – $5 / month | $1 – $9 / month | 0.25% – 0.40% | $0: stock / ETF trades

$5 / month: Robinhood Gold |

| Account Types | Investment, SEP, Roth IRAs, rollover IRAs, UTMA / UGMA | Investment, traditional / Roth IRAs, custodial accounts | Investment, SEP, Roth IRAs, rollover IRAs, Trusts | Investment |

| Options to Earn | Yes | Yes | Interest | Interest |

| Automatic Rebalancing | Yes | No | Yes | No |

Our Acorns retirement review determined that this service is unique in providing the Round-Ups feature together with additional opportunities to earn cashback and bonuses. It motivates new investors to take the first step into saving for the future and learning how to manage their investments.

Is Acorns Worth It?

Acorns is a good place to start if you are new to the game of investment and want minimal input into the process. If you have a decent account balance, the monthly fees are affordable and the Round-Ups feature is a good way to save. However, fees on smaller account balances are just not worth the effort.

If you think that investing is a good idea, but are unsure of how to go about it, this Acorns investment app review should convince you that Acorns may very well be what you need.

FAQ

Acorns is a legitimate platform to use to try your hand at micro-investing. It is safeguarded by a variety of security features to ensure that your investment and banking details are protected from fraudsters.

In order to withdraw your accumulated funds from Acorns simply log in to your account via your mobile device. Select Invest for Your Future and proceed to the Withdraw tab. Enter the amount you wish to withdraw and complete the transaction. Automatic rebalancing will be completed.

Acorns’ services can be used by selecting one of the tiered pricing plans. The Personal Plan costs $3 monthly while the Family option incurs a $5 management fee. Although no additional fees are charged on minimum balances for overdrafts, a 0.25% levy is charged on account balances over $5,000.

As we discovered when researching for this Acorns review, the company invests funds from your account in portfolios comprising a selection of 12 different exchange-traded funds (ETFs). Account holders can select the level of risk they are willing to take on – from moderate to aggressive.

![Detailed Tractive Reviews [Features, Prices, Alternatives and More]](https://review42.com/wp-content/uploads/2022/04/feature-image-review42-logo-tractive-reviews.jpg)