- Appointments scheduling: ★★★★★ 5/5

- Customer management: ★★★★★ 5/5

- Team management: ★★★★★ 5/5

- Integrations: ★★★★☆ 4/5

- Automation: ★★★★☆ 4/5

- Ease of use: ★★★★★ 5/5

- Price: ★★★★★ 5/5

Square Appointments Review for 2024

Fact-checked

Fact-checked

Last Updated: February 13, 2024

- Appointments scheduling: ★★★★★ 5/5

- Customer management: ★★★★★ 5/5

- Team management: ★★★★★ 5/5

- Integrations: ★★★★☆ 4/5

- Automation: ★★★★☆ 4/5

- Ease of use: ★★★★★ 5/5

- Price: ★★★★★ 5/5

Best For

Individuals or small businesses

STRENGTHS

- Provides online as well as offline access to customers’ data

- Offers free plans for individuals

- Easy to sign up

WEAKNESSES

- Syncs only with Google Calendar

- Limited flexibility in resource management

Managing a business includes juggling many tasks like appointments, bookings, payments, receipts, and generating leads. While there is different software available for each of these, what if we tell you you can do all this using one single software?

In this Square Appointments review, we’ll discuss its main features, ease of use, pricing, etc. Read on to see if it’s a good solution for your business.

What Is Square Appointments and How Does It Work?

It’s an appointment scheduling software with integrated point-of-sale (POS) and payment processing. This software is good for anyone running a business and it comes with additional features like managing calendars, customer information, and stock. It also has a free mobile app and offers an online booking platform to help you access your business’s data from anywhere.

When I first started researching this software, I was impressed by the numerous useful features it offers. Square online booking and POS integration help business owners to manage their entire logistics using one software only. This saves businesses the bother of having to purchase different software for each function. Moreover, most software caters to the needs of businesses, whereas Square Appointments also focuses on individual professionals’ needs.

To understand how Square Appointments works, take a look at the following steps:

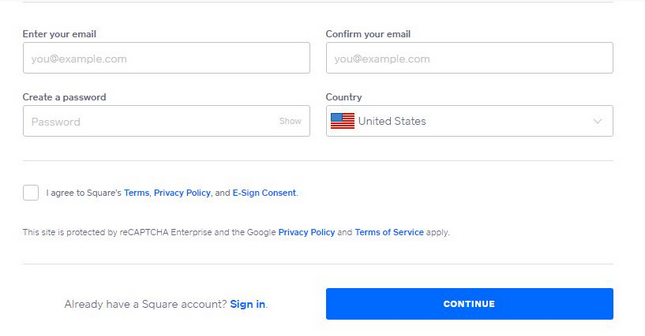

Sign Up

You should first sign up and create your account. You can choose from either the individual plans or staff plans. The first is free while the staff plans require monthly payments. Take a look at the various plans available and choose the best suitable one for yourself or your business. You can also download the app and set up the software on multiple devices.

Services

The next step is creating bookable services for your clients. You can choose separate services for each staff member too. You can list the pricing, enable online booking, and even set the order in which you want services to appear on the booking site. It offers a website embed feature where you can add the booking option on your website.

Online Booking

Lastly, it is important to schedule a test Square appointment. This will not only help you manage your meetings but also help you look at your business from a customer’s perspective.

Main Features

Here are a few of the many features that make this software stand out from its competitors:

Online Booking

One of the best features Square Appointments offers is its online accessible booking channels. You will receive a ready-made booking site that you can operate or integrate with your business website. Customers can then browse through the various services offered and choose the time slots set by you.

Payments

One thing that really impressed me about Square appointment booking was that the owner has complete control over the payments and discounts. You can set up payment options and even charge a cancellation fee if the customer does not show up for the appointment.

Built-in Point of Sale

Square Appointments offers a built-in POS system. It is easy to use and enables you to accept all the major forms of payments. It is efficient regardless of whether you’ve locally installed the software or are using the cloud-based version. The POS automatically calculates fees, taxes, discounts, and prices.

Client Data Management

Managing customers’ data is very important for every business. Square’s software will help you save customers’ data including their name, contact information, and previous payment history to create customer reports. You can also use it to create loyalty rewards or invite clients.

Calendar Management

Square appointment reminders help you manage your calendar as well as set up reminders when you have an appointment. It allows clients to look at the calendar and choose the right time and date for their appointment. This saves time in booking the meeting. It also gives you calendar views to manage your clients better and it’s an overall great calendar app for Mac as well as Android devices.

Ease of Use

This software is very easy to use. Many of the Square scheduling reviews appreciate how intuitive this software is. Here are the simple steps to set up your account:

Step 1: Visit the Website

Sign up for free if you don’t already have an account.

Step 2: Fill in Your Information

The next step is to fill in your information and confirm your email.

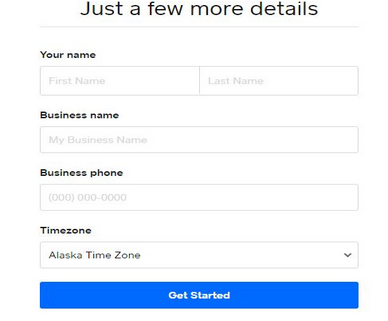

Step 3: Just a Few More Details

Here you need to fill in a few more details to get started with your Square appointment account.

After signing up you can browse through the various plans and choose the right one for your business. It’s that easy! You can contact customer support if you face any issues or wish to learn more about the software.

Plans, Pricing, and Contracts

| Appointments Plan | Monthly Cost | Locations | Best For | Staff |

| Free | $0 per month for a single location. | 1 location only | Individuals like tutors, freelancers, independent contractors, etc. | Unlimited |

| Plus | $29 per month, per location. | Unlimited | Small businesses with few employees | Unlimited |

| Premium | $69 per month, per location. | Unlimited | Medium-size businesses | Unlimited |

| Custom Pricing* | Contact sales | Unlimited | Medium to large businesses | Unlimited |

As you can see Square Appointments pricing varies from plan to plan. If you’re a freelancer, it is best to choose the free plan since it is specifically designed for individuals. Check out our article on free appointment scheduling software for more choices.

As your business grows, you can choose from the paid plans offered by Square. It should be noted that despite the prices, the features offered are the same in all plans. The only difference is in the number of employees. You can also choose the hardware, such as the POS system, as an add-on in all the plans.

Here are some additional payment fees charged by Square per transaction:

- Payments via Square virtual terminal: 3.5% + 15 cents

- Payments via Square online store: 2.9% + 30 cents

- Manual card entry through POS app: 3.5% + 15 cents

- Square invoices: 2.9%+ 30 cents

Customer Support

You can contact customer support through their phone number 855-897-1838. You can also send an email. Based on Square Appointments reviews, customers were happy with the customer support.

Alternatives

| Square Appointments vs | Schedulista | Calendly | OnSchedule |

| Win | Square offers a free plan | Square is available as an Android app | Square offers a free account and can support large businesses |

| Lose | Offers attendance tracking | Does not require a credit card | Can support large businesses |

| Best For | Schedulista is suitable for students | Calendly is suitable for all businesses | Large businesses |

Square Appointments is suitable for individuals or small businesses. It offers a free plan and is also available as an app for Android and iOS.

Is Square Appointments Worth It?

Now that we’re coming to the end of our Square Appointments review we can conclude that Square Appointments is suitable for individuals, independent contractors, and small businesses, offering all the necessary features.

FAQ

Yes, Square is specifically designed to help you schedule appointments.

After creating your Square account, you can integrate it with your website. The clients can use the appointment schedule tool to easily book their services as per availability.

After reading this Square Appointments review and many others, it is clear that Square Appointments is in fact a good appointment scheduling software. Its minor flow is that it only syncs with Google Calendar.