![2022 SBG Funding Review [Terms & Requirements]](https://review42.com/wp-content/uploads/2021/05/SBG-Funding.png)

- Minimum time in business: Six months

- Credit score required: 500+FICO Score

- Loan Term: Six months to five years

- Funding time: Within 24 hours

- APR: Starting from 1.75%

- Borrowing amount range: $5,000 - $5 million

2022 SBG Funding Review [Terms & Requirements]

Fact-checked

Fact-checked

Last Updated: February 1, 2023

- Minimum time in business: Six months

- Credit score required: 500+FICO Score

- Loan Term: Six months to five years

- Funding time: Within 24 hours

- APR: Starting from 1.75%

- Borrowing amount range: $5,000 - $5 million

Best For

Those Who Need Flexible Financing Solutions

STRENGTHS

- Provides loan opportunities for a wide range of industries

- No prepayment penalties

- Flexible and relaxed requirements

- No SBG grant frauds reported

- Large loan amounts available

- Low APR and interest rates

WEAKNESSES

- Business needs to have a monthly revenue of $10,000

- No reward programs or special benefits

Hundreds of businesses have used SBG’s financing solutions because of their favorable loan terms, low credit score requirements, and quick funding. With an 85% approval rate, the company comes highly recommended to those with bad credit.

Providing one of the best SBG Funding reviews, our expert team didn’t leave one stone unturned. In this review, you’ll read the company’s application process, requirements, terms, features, pricing and fees, and more.

Company Overview

SBG Funding, established in New York City (NYC) in 2017, is a financial loan provider for small businesses—creating flexible financing solutions at affordable rates, regardless of the type of industry or credit background.

Product Overview and Features

SBG Funding offers six different financial solutions:

- Small business term loans

- Business line of credit

- Bridge capital

- Equipment financing

- Invoice financing

- SBA 7(a)—Small Business Administration loan

Let’s consider two of the company’s most significant products—business line of credit and small business term loan:

Business Line of Credit

With a business line of credit from SBG Funding, business owners have the opportunity to be approved for a maximum amount of revolving credit. And you can withdraw any amount of money at any time, as long as it doesn’t exceed the amount approved. This gives clients the convenience of only repaying what they withdraw from the account.

Successful applicants can receive a credit line of up to $150,000 within 24 hours. Terms range between 6 and 24 months of revolving credit. SBG funding requirements for lines of credit are similar to that of a small business loan.

Small Business Term Loan

SBG Funding specifically caters to the small business owner who needs a cash injection. If you have bad credit and aren’t being approved by other larger lending companies, then this product is one of the first business loans worth considering.

Eligible candidates should be in business for at least six months, have more than $10,000 monthly revenue, and a FICO score of over 500. When applying, you should also be able to provide six of your most recent bank statements.

Terms range between 2-5 years. Approved candidates can receive up to $5 million in funding within 24 hours.

With your small business loan you can:

- Test new marketing campaigns

- Purchase additional inventory

- Expand to new locations

- Establish and build your business credit

PPP 2.0 and EIDL 2.0

In addition to SBG’s seven conventional products, they also offer SBG small business grant assistance by way of the Paycheck Protection Program (PPP)—which is part of the new US government stimulus bill that offers relief to employers and employees affected by the global COVID-19 pandemic.

PPP 2.0 is specifically for businesses with less than 300 employees. The plan offers:

- Loan amounts of 3.5 times more than the business’ monthly payroll cost.

- A second withdrawal to pre-PPP loan receivers.

EIDL 2.0 is specifically for businesses in low-income communities that have more than 500 employees. The plan offers:

- Maximum loan amounts of up to $2 million.

- Repayment terms of up to 30 years.

Note that SBG isn’t the processor of PPP loans but provides SBG resources and advisory services that assist small business owners in applying for PPP loans—cutting out the middleman and making peer-to-peer lending possible.

SBG Funding’s Borrower Requirements and Terms

SBG Funding boasts lenient criteria when it comes to borrowers’ eligibility. Note the company’s requirements and terms:

| Features | Data |

| Minimum time in business | At least six months |

| Credit score required | 500+FICO Score |

| Annual revenue required | $10,000 monthly revenue + six most recent business bank statements |

| Borrowing amount range | Between $5,000 and $5 million |

| Origination fee (or any other fee) | Dependent upon loan agreement |

| Loan Term | Six months to five years |

| Funding time | Within 24 hours |

| Location requirements | US |

| Eligible industries | Construction, Manufacturing, Healthcare, HVAC, Restaurants, Automotive Services, Retail, Veterinarian, Trucking and Transportation, Beauty and Wellness |

| Personal loan guarantee required | 85% |

| Collateral | None |

| APR | Starting from 1.75% |

It is undetermined if an SBG Funding application is offered to business owners with active bankruptcies. But with an approval rate of 85% and a low credit score requirement, a simple inquiry is worth the effort.

Pricing and Repayment Fees

The following APR rates with SBG are applied to different loan types:

- Small business loan: 1.75% per month

- Line of credit: 1.75% per month

- Equipment financing: 3.75% per month

All rates are dependent upon your business’ specific financial situation.

SBG funding rates for the PPP 2.0 program:

- Repeat PPP borrowers receive a 1% interest rate.

- Forgivable tax deductibles if 60% is used for paying salaries.

Rates for the EIDL 2.0 program:

- 3.75% fixed interest rates.

- 2.75% fixed interest rates for non-profits.

- No prepayment penalties.

- Forgivable grants of up to $10,000.

- No fees for advisory services.

How Does Repayment Work?

Repaying small business loans is straightforward and easy. There are no prepayment penalties—if you want to pay off your loan earlier, you can do so without worrying about additional costs. Flexible solutions also give clients the option to pay biweekly or monthly, allowing you to avoid added interest rates or other additional costs.

Repaying a line of credit has no prepayment penalties or hidden fees. Options to pay either monthly or weekly are available. SBG funding rates may vary, depending on the lender’s criteria and the state’s rules and regulations.

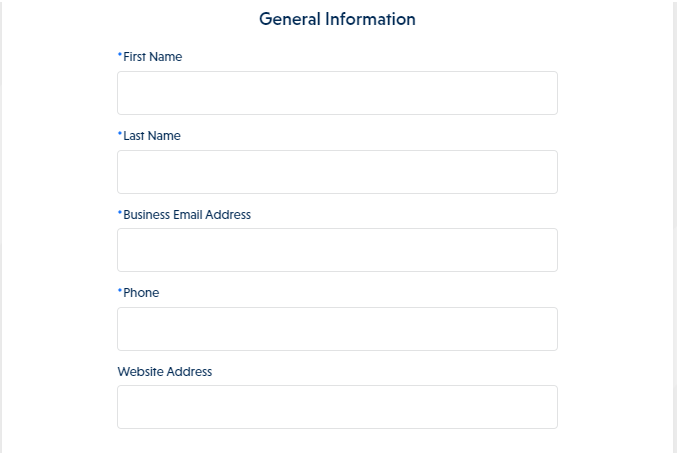

Application Process

SBG’s 10-minute application process is as easy as ‘one-two-three’. Here’s is a step-by-step guide on how to apply for SBG funding online:

Step 1

Go to https://sbgfunding.com/apply-now/ and fill in your:

- Full name

- Business email address

- Phone number

- Website address

- Business information

Step 2

Sign the e-application

Step 3

Upload the necessary files and documents, including:

- Bank statements of small business credit card usage

- Income statements

- Federal tax Information

- Legal entity type

After you’ve filled in this quick application, an agent will contact you within 24 hours. Go through the terms and conditions, accept the offer, and receive funds into your bank account on the same day.

For those who don’t want to complete an online application, there are paper applications available here.

Unlike other credit card providers—who perform hard credit inquiries on your credit score—an SBG Funding application will not impact your credit score.

SBG Funding Alternatives

Two of SBG Funding’s strongest competitors include Credit Suite and National Funding. Let’s see how they compare:

| Company | Win | Lose | Best |

| SBG | Lower rates | Lower loan amounts in comparison to other companies | Great terms, and there is no prepayment penalty |

| National Funding | Lower annual revenue needed (100,000) | Smaller loan amounts | The company approves applicants with a credit score of 500 and above. |

| Credit Suite | Better loan repayment terms, up to 20 years. | The company requires a good credit score. | It’s a good option if you have good credit and need a loan of up to $12 million. |

| Lendio | The company offers a variety of loans. | Low loan amounts | A good option for new businesses |

Even though some companies offer higher loan amounts, SBG Funding offers a perfect combo of low-interest rates, more than good loan repayments terms, and high enough loan amounts that any small business can benefit from.

SBG Funding Reviews and Ratings

Although it’s common for loan companies to have a few negative reviews, SBG has had mostly positive ones. Accredited by the BBB since November 2017, SBG Funding has an A+ rating and a 4.47 star rating from customer reviews.

Privacy and Security Policy

Part of SBG Funding’s terms and conditions states that by providing your information, you authorize prospective third-party funding providers and Mission Capital LLC (Doing Business As SBG Funding) to contact you by the contact numbers you provide.

Is SBG Funding Worth It?

SBG funding gives small businesses the opportunity to grow by allowing easier access to credit lines and financial assistance to businesses by providing PPP and EIDL programs to help overcome financial difficulties brought on by the COVID-19 pandemic. All in all, low APR rates, relaxed minimum requirements, and fast approval, among other things, makes it an excellent option for small businesses.

FAQ

Potential customers can contact qualified agents by email (info@sbgfunding.com) or by phone at (844) 284-2725. Alternatively, you can visit their offices at 135 E. 57th Street, New York, NY 10022 or subscribe to their newsletter for regular updates.

SBG Funding is a financial service provider that caters to small businesses—offering small business loans and credit lines to help young businesses develop and reach their full potential.

Yes, SBG Funding is an accredited financial service provider with the Best Business Bureau (BBB) since November 15, 2017.

Yes, hundreds of credible SBG Funding reviews online vouch for the company’s legitimacy and trustworthiness.

![Upstart Reviews: Does It Live up to the Hype? [2024]](https://review42.com/wp-content/uploads/2021/02/Upstart-Reviews-featured-image.jpg)